Philosophy & Process

Core Principles

- Valuation and quality must always factor into an investment manager’s decision-making process.

- There is no substitute for independently assessing a company’s valuation and future growth prospects.

- Investment practitioners have a perpetual obligation to evaluate the risks and merits of going against the crowd.

Philosophy

At its core, investing is about understanding and interpreting information and subsequently making a decision, an investment, based upon in-depth analysis. While in-depth analysis is an essential component to an investment process, it alone does not minimize the uncertainty of the future nor does it minimize how company information (i.e., level of revenues, operating margins and cash flow) will be evaluated and interpreted by investors. We believe quantitative techniques, combined with rigorous fundamental analysis, can help minimize the impact of uncertainty and provide a runway for impactful investment results.

We Believe...

Owning high quality companies not fully appreciated by investors generates excess returns.

Therefore, We...

Manage core portfolios that invest in companies traditionally characterized as both growth and value.

Broadly diversify across sectors and companies.

Process

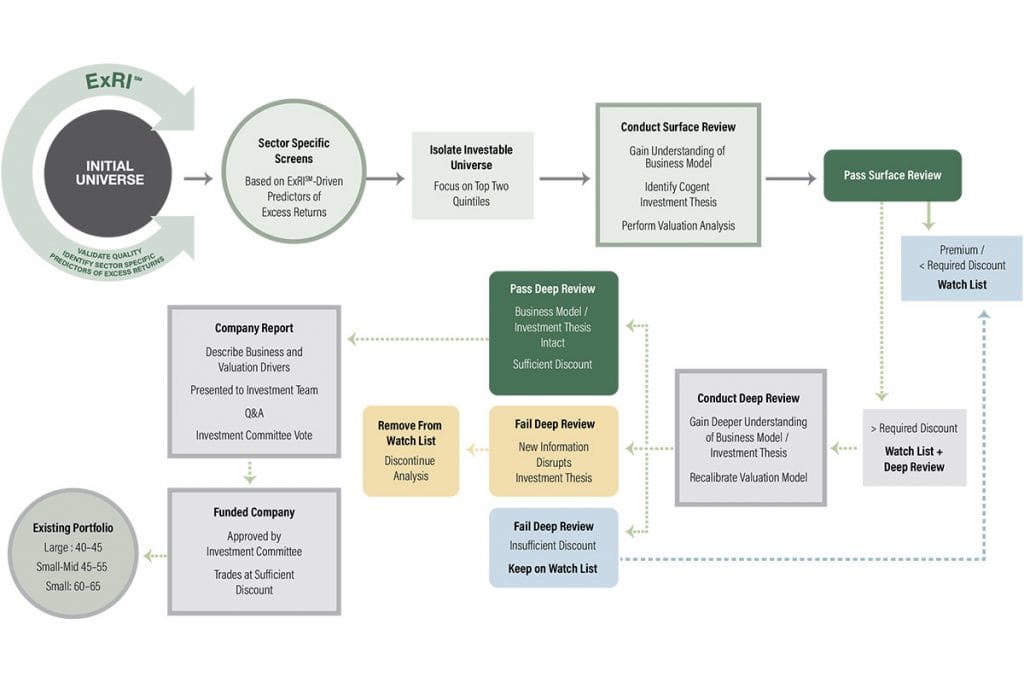

Domestic Equity Investment Process

Our proprietary Excess Return Identifier (ExRISM) process assists us in identifying what we believe are sector-specific drivers of future excess return, harnessing the predictive advantages that EVA* confers. Through ExRISM, we isolate our identification of high-quality companies that possess these drivers, allowing us to efficiently isolate our search to the most selective and advantageous investment opportunities. We augment ExRISM ’s distinctive screening advantage with rigorous quality and valuation analyses. What this means for investors is that they are beneficially exposed to a process that is aligned with the most important tenets of equity investing: owning high quality companies that appear underappreciated by investors, elements that we believe pave the way to recognizing excess returns in a risk-controlled manner.