Introduction

The pressure to showcase positive earnings momentum via adjusting GAAP (Generally Accepted Accounting Principles) figures to “something better” has persisted for years. Adjustments that had been confined to items such as “restructuring charges” and “impairment charges” are now increasingly housing share-based compensation as well. In this latest edition of Isthmus Insights, we explore the prevalence of this trend in the aggregate and by sector.

Until 2006, share-based compensation (which mainly relates to employee stock options) was simply reported in the notes section of the financial statements in accordance with GAAP but did not clearly impact the financial statements themselves. In 2006, FAS 123 of the GAAP code was modified to require companies to show options as an expense on the income statement. This means that the costs of these options must be shown as employee compensation along with salaries and other expenses. Moreover, the revised FAS 123 (FAS 123r) required the use of a fair-value accounting approach to provide some standardization while stopping short of requiring a specific approach.

The argument for expensing options was straightforward: lower than market salaries could be offered since options were granted to employees. In the end, both components can be viewed as compensation, yet companies’ profits could be inflated since the latter did not appear on the income statement before the accounting change. The other side of the argument is that an option expense is non-cash that should be ignored and that any in-the-money options will already be counted in the diluted share count, dampening earnings per share.

So how have companies handled the accounting change?

Many provide pro-forma statements for investors that show profit before the expensing of options. What follows is a dissection on how the prevalence of share-based compensation has changed over the past 15 years and the nuances by sector.

Data and Commentary

The fact is that companies are giving an optical boost to earnings per share by backing stock option expense (SOE) from reported numbers. To be sure, GAAP numbers include SOE in results and are reported by every company. However, nearly every company highlights Non-GAAP EPS, Adjusted EPS, or some similarly coined term in the headlines of an earnings report, followed further down – often near the very bottom of the press release – with a GAAP to Non-GAAP reconciliation table. We looked at the S&P 1500 Technology sector (a large and relatively heavy user of SOE in compensation) to determine the prevalence of reporting an Adjusted EPS number that excludes stock option expense. In each respective company’s most recent earnings release, 105 out of the 162 constituents did just that. And in fact, this percentage is increasing. While we were able to get a list of the Technology constituents of the S&P 1500 from fifteen years ago, we were not able to dig up an old earnings release from every single one of them for various reasons (many of those companies currently do not exist, for example, perhaps due to an acquisition or bankruptcy). That said, we were able to dig up results on nearly 150 of them and of that amount, just 32% – less than one-third – were making this adjustment 15 years ago.

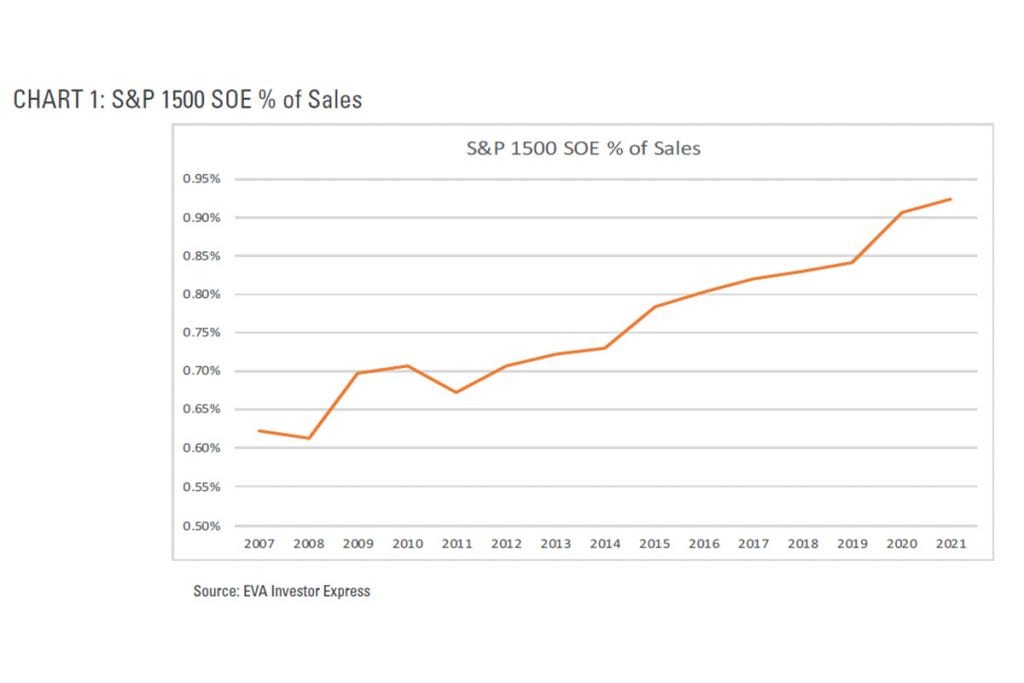

To analyze how meaningfully the value of stock option grants has changed over time, we studied the median level of SOE as a percent of sales over the last fifteen years in both the S&P 1500 Index and within each sector. In 2007, the first year after the accounting changes noted above, stock option expense represented 62 basis points of sales for the S&P 1500 as a whole. These percentages have been on a fairly steady increase since then. Last year, it totaled 92 basis points as a percentage of sales, an increase of nearly 50%. This means that not only is the absolute level of stock compensation rising, but also the expense line is growing faster than the revenue of the firms utilizing it, on average.

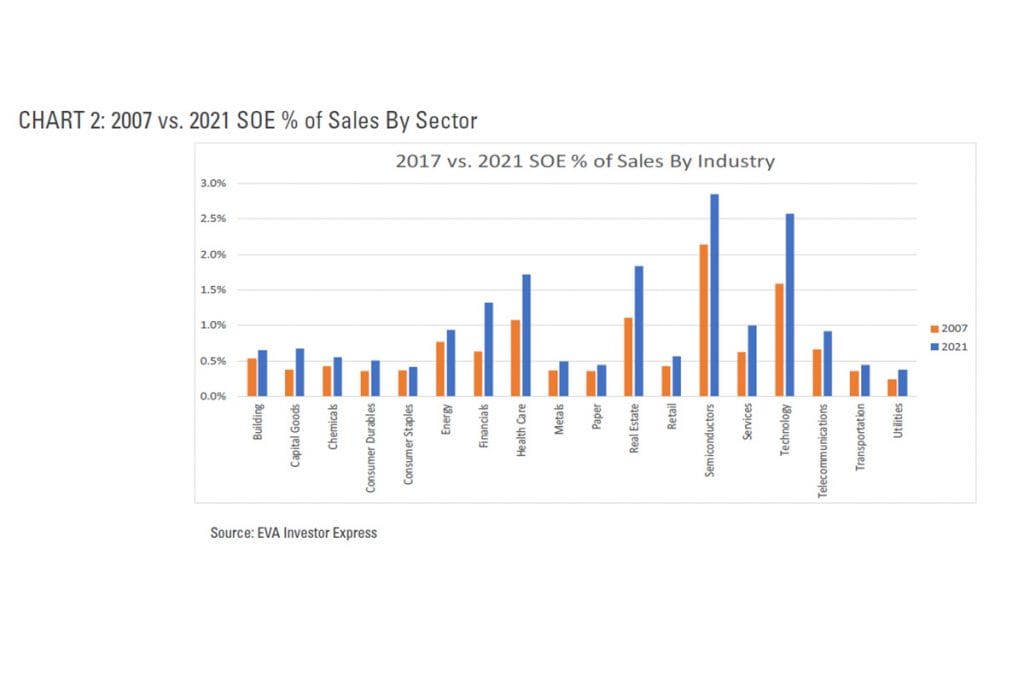

As you would expect, usage varies significantly by sector. It makes sense that industries more heavily populated with hypergrowth startups, perhaps opportunity rich but cash poor, would be heavier users of stock options in compensation. The data bears that out. When normalized as a percentage of sales, the Semiconductor and Technology sectors were the heaviest users at 2.85%

and 2.58% of sales, respectively. Within some sectors the increase compared to 2007 is even more pronounced than the S&P 1500 as a whole. SOE has more than doubled in the (non-bank, non-insurance) Financials sector to over 1.3% of sales compared to just 64 basis points fifteen years ago. The graphic below shows that stock option expense as a percentage of sales has increased in every single sector over the past fifteen years.

Conclusion

That the increasing prevalence of backing out SOE is occurring is not a surprise, yet we believe the magnitude of the shift (as a % of sales and, in the case of Technology companies, the >100% higher usage of the practice) is meaningful. Backing out SOE ignores the potential transfer of ownership from shareholders to employees (“potential”, since options can expire worthless or can be forfeited). Prior to the accounting standard change, investors took varied approaches to measure the associated cash flow and dilution impacts,

arriving at disparate conclusions.

Isthmus Partners recognizes that the impact of FAS 123r is not perfect in terms of matching future cash flows with what will ultimately transpire, yet we believe the standard leans conservative; employees receive something of value immediately upon grant and the company recognizes this expense over their requisite service periods. To the extent that companies attempt to neutralize dilution by repurchasing shares (at market prices) to offset in-the-money option exercises (at below-market share prices), FAS 123r does a suitable job as a proxy for the cash impact of stock option expensing. We do not see SOE add-backs going away, particularly when many compensation plans continue to utilize adjusted earnings as a means of incentive payments for top management. Isthmus Partners believes that the impact of including SOE is a true expense. We routinely include the full expense, which reduces cash flow for valuation modeling purposes. While at times this approach proves to be a conservative technique, it allows for greater conviction when selecting high quality companies that are trading at levels not fully appreciated by investors.